CBDT has given Income Tax Residency Status Relief for NRIs and Foreign Nationals, Lockdown period won’t be counted for determining Residency Status

CBDT has issues Circular No. 11 of 2020 dt 8th May,2020 clarifying residential status u/s 6 of Income Tax Act wrt FY 2019-20 (AY 2020-21) giving relief on residency status to NRIs/foreign visitors whose stay in India got prolonged due to lockdown. Prolonged stay in India to be discounted.

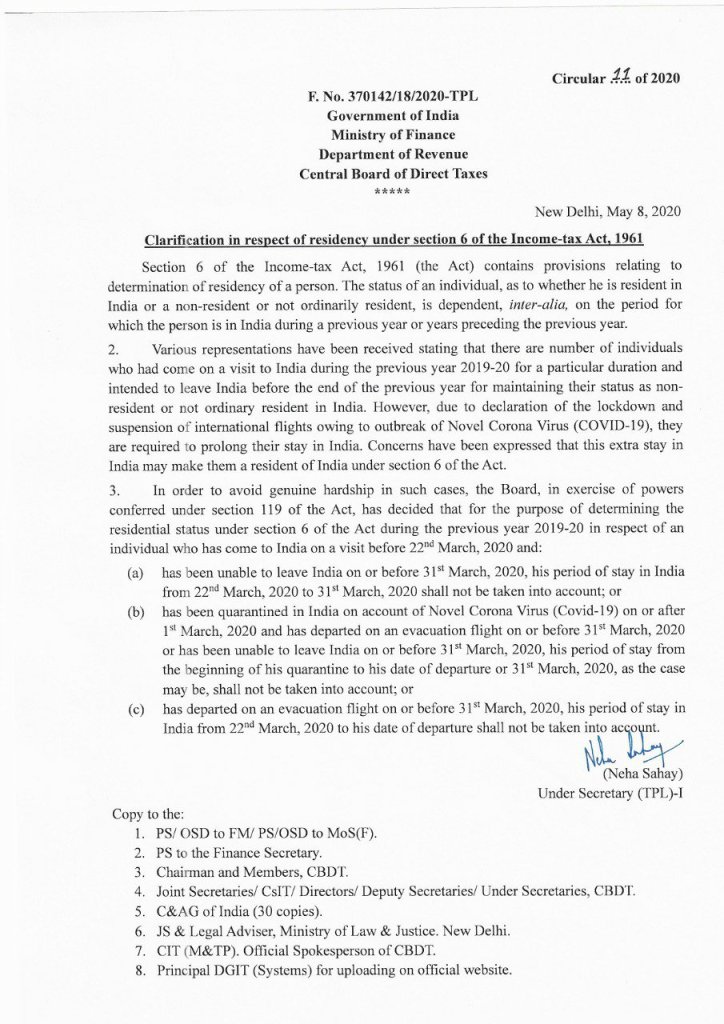

F. No. 370142/18/2020-TPL

Government of India

Ministry of Finance

Department of Revenue

Central Board of Direct Taxes

Circular :11 of 2020

New Delhi, May 8, 2020

Clarification in respect of residency under section 6 of the Income-tax Act, 1961

1. Section 6 of the Income-tax Act, 1961 (the Act) contains provisions relating to determination of residency of a person. The status of an individual, as to whether he is resident in India or a non-resident or not ordinarily resident, is dependent, inter-alia, on the period for which the person is in India during a previous year or years preceding the previous year.

2. Various representations have been received stating that there are number of individuals who had come on a visit to India during the previous year 2019-20 for a particular duration and intended to leave India before the end of the previous year for maintaining their status as non-resident or not ordinary resident in India. However, due to declaration of the lockdown and suspension of international flights owing to outbreak of Novel Corona Virus (COVID-19), they are required to prolong their stay in India. Concerns have been expressed that this extra stay in India may make them a resident of India under section 6 of the Act.

3. In order to avoid genuine hardship in such cases, the Board, in exercise of powers conferred under section 119 of the Act, has decided that for the purpose of determining the residential status under section 6 of the Act during the previous year 2019-20 in respect of an individual who has come to India on a visit before 22nd March, 2020 and:

(a) has been unable to leave India on or before 31st March, 2020, his period of stay in India from 22nd March, 2020 to 31st March, 2020 shall not be taken into account; or

(b) has been quarantined in India on account of Novel Corona Virus (Covid-19) on or after 1St March, 2020 and has departed on an evacuation flight on or before 31′ March, 2020 or has been unable to leave India on or before 31st March, 2020, his period of stay from the beginning of his quarantine to his date of departure or 31st March, 2020, as the case may be, shall not be taken into account; or

(c) has departed on an evacuation flight on or before 31st March, 2020, his period of stay in India from 22nd March, 2020 to his date of departure shall not be taken into ac o nt.

(Neha Sahay)

Under. Secretary (TPL)-I