RBI allows Indian Resident to open foreign currency accounts in GIFT City under LRS

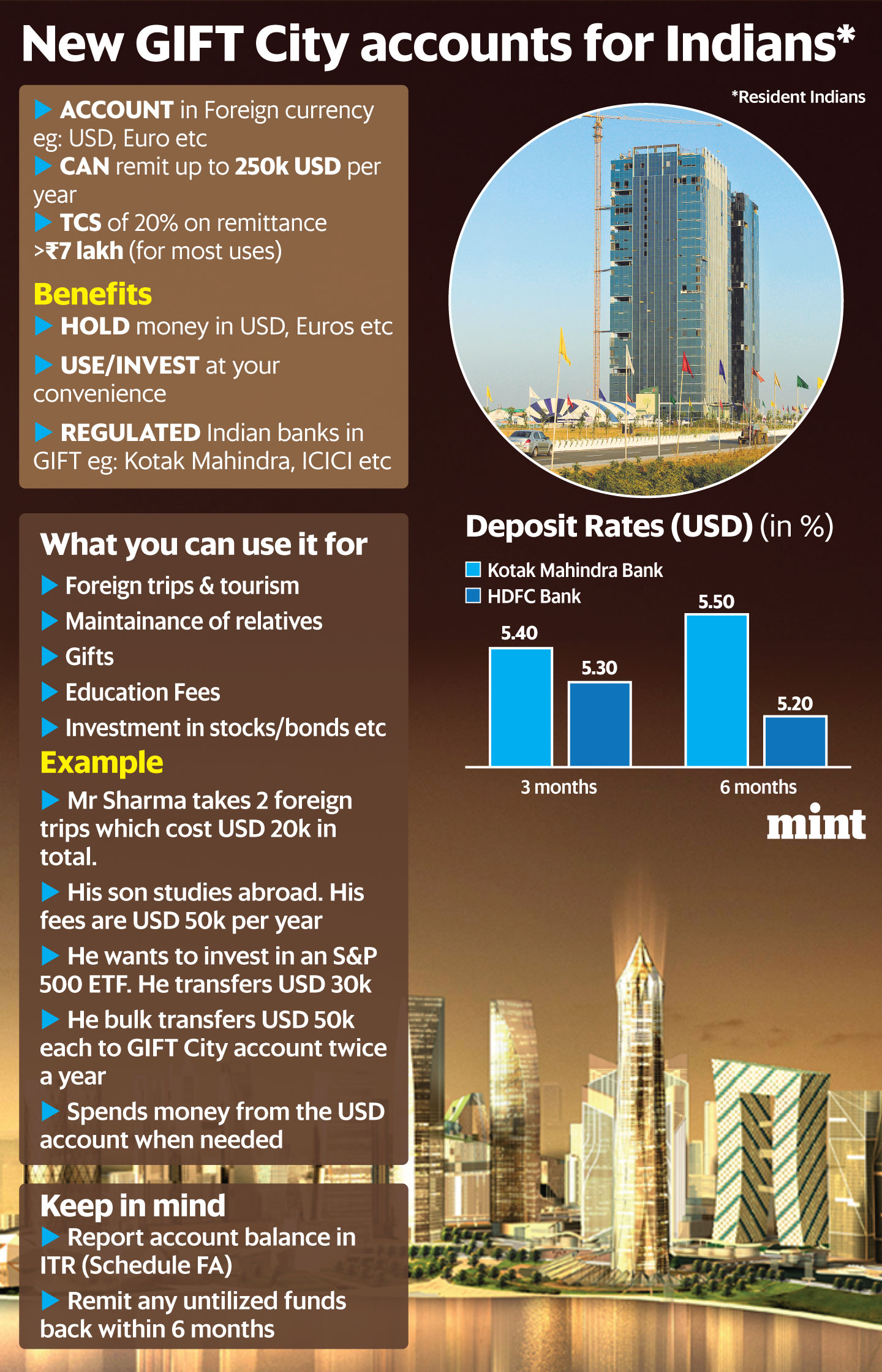

The new RBI circular allows an Indian Resident to open foreign currency accounts in GIFT City under its Liberalized Remittance Scheme (LRS).

You can utilise the US Dollar remitted to your GIFT City account for any permissible purpose such as tourism, maintenance of relatives, gifts, investing in stocks/ETFs/bonds or education.

One needs to take care of following :

1. Utilise the money within 6 months of transfer, i.e invest in foreign stocks/bonds/ETFs or spend it on foreign education, tourism or maintainance of relative residing outside India within 6 months.

2. The accounts have to be declared in Schedule FA (Foreign Asset) in the Income Tax Return.

Infographic shared by Neil Borate

- MCA issues Merger and Amalgamation Amendment Rules effective from 17th September. - September 11, 2024

- Taxation of ESOPs - August 14, 2024

- Block Assessment in case of Search Proceedings Re-introduced in the Budget 2024 - August 7, 2024